rsu tax rate us

Unlike the much more complicated ESPP they get taxed the same way as your income. Market value of shares.

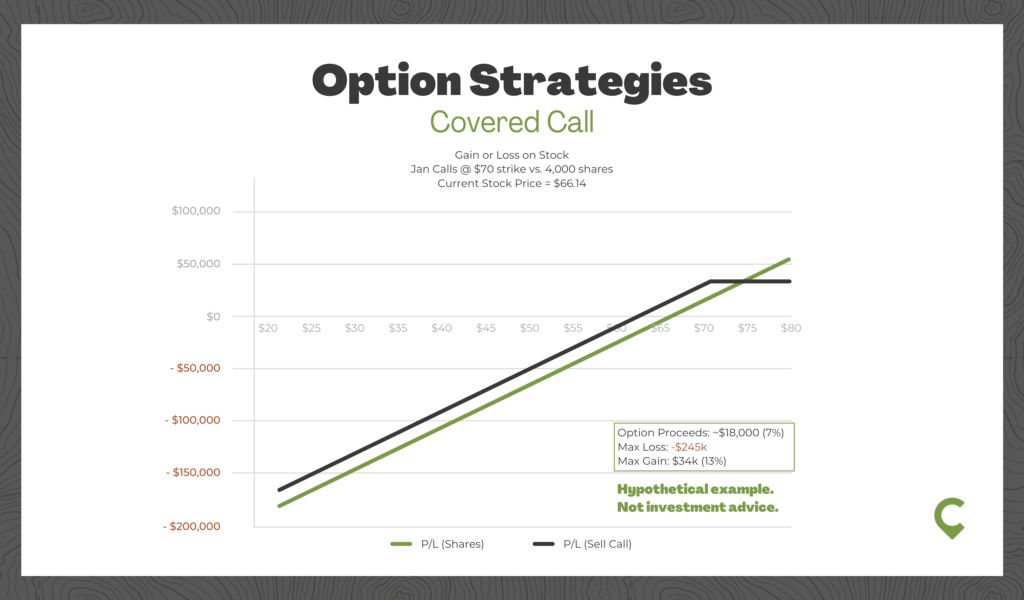

Compare how the total payout may change between options and RSUs.

. Generally there is no. The page explains about taxation of Restricted Stock Units RSUs. Rsu tax rate us Friday September 9 2022 Edit.

Vesting Schedule Hypothetical Future Value Per Share. Ad Thinking of switching from stock options to RSUs restricted stock options. Vesting after Medicare Surtax max.

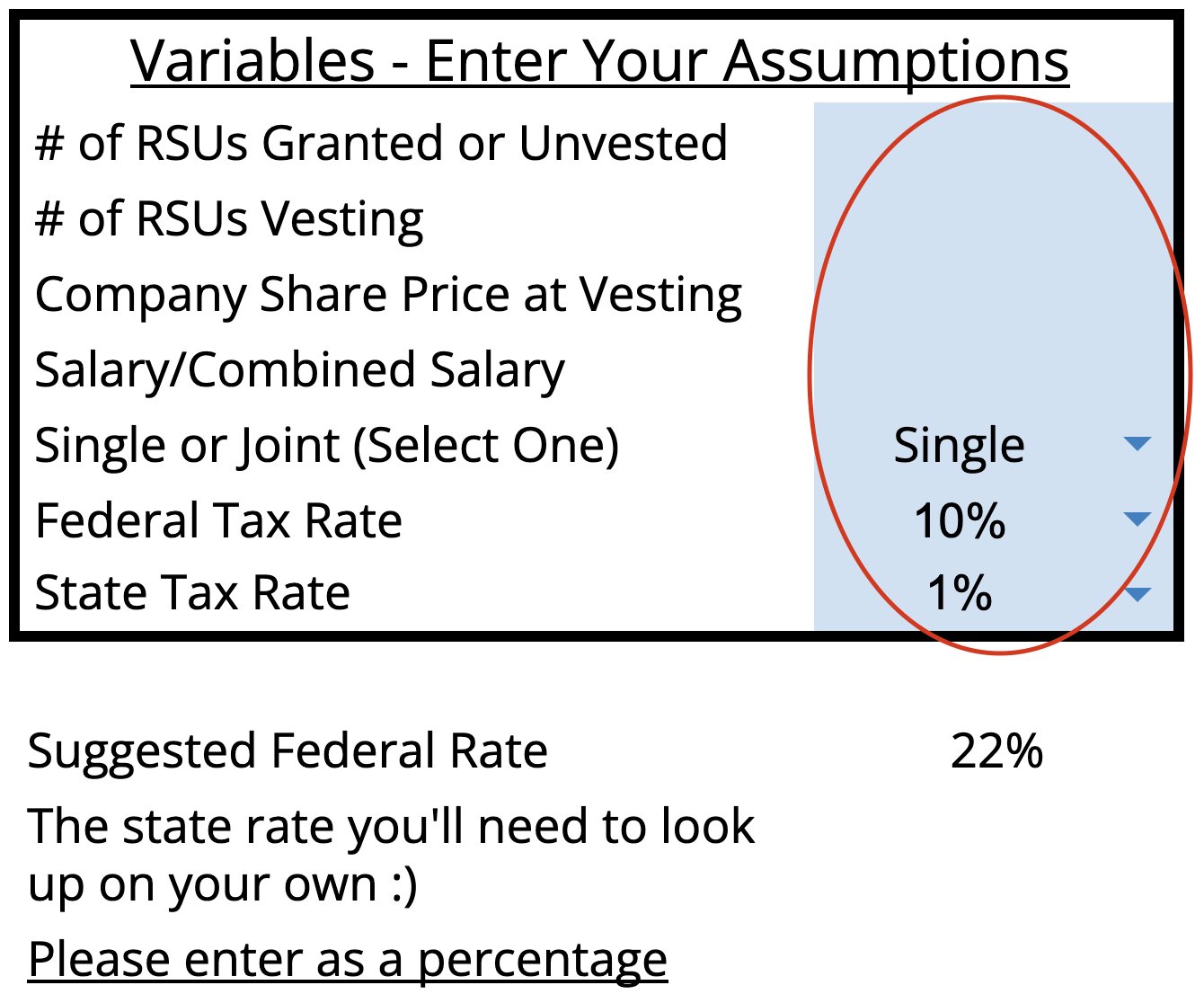

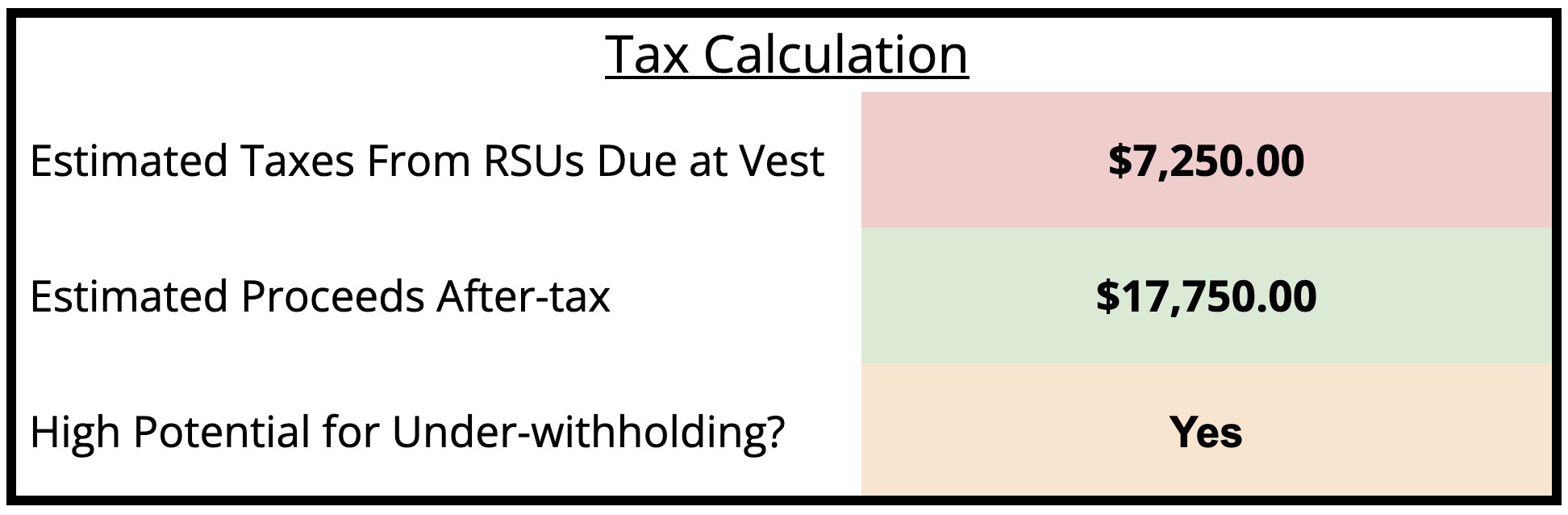

Most employers will withhold taxes on your RSUs at a rate of 22 but you could easily be in a higher tax bracket than that. Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees. Vesting after Social Security max.

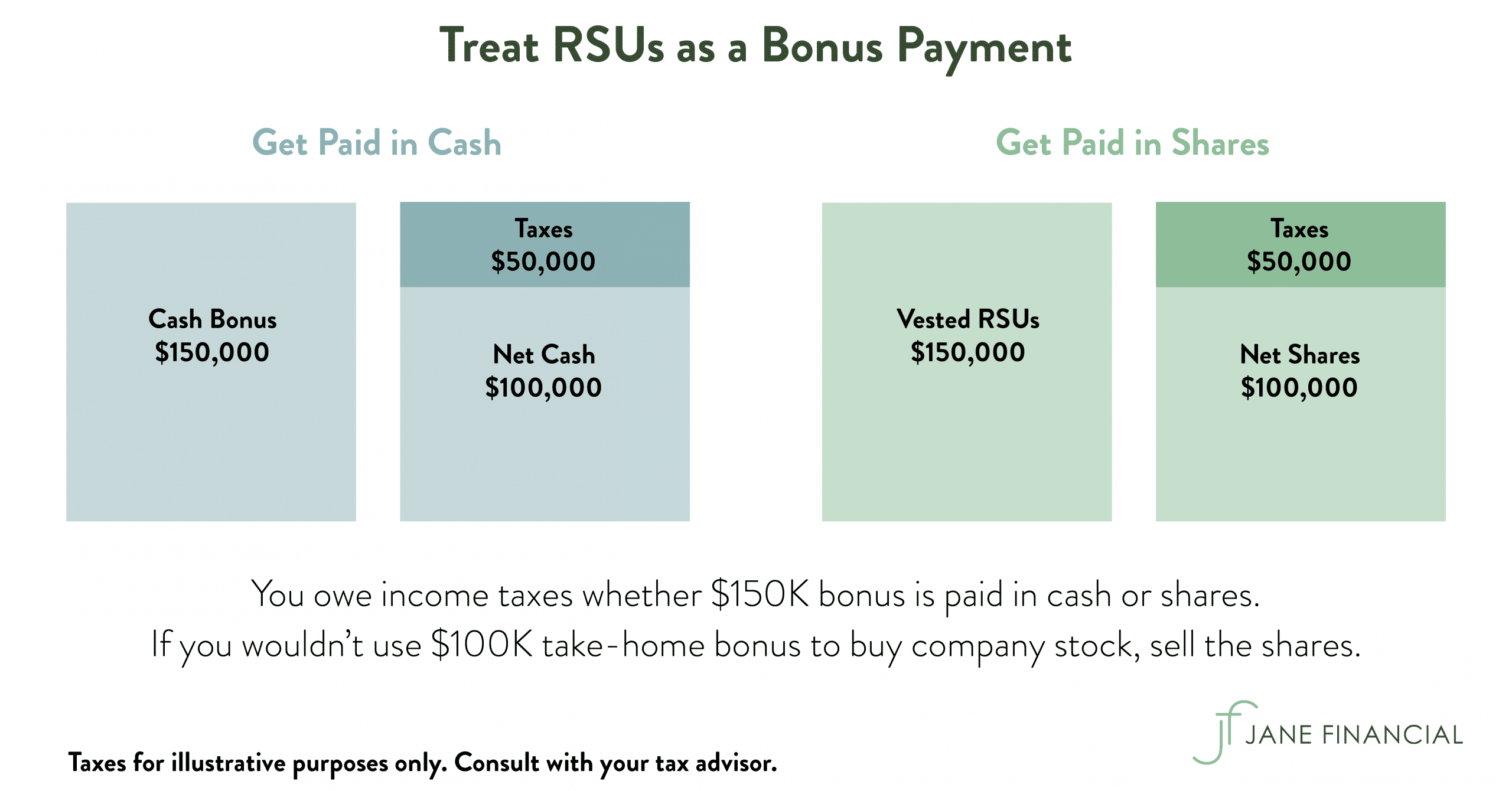

The stock is restricted because it is subject to certain conditions. If you already earn in excess of this and the. Taxes are usually withheld on income from RSUs.

Vesting after making over 137700. RSU Taxes - A tech employees guide to tax on restricted stock units. 44 020 7309 3851.

If you live in a state where you need to pay state. Ordinary tax on current share value. For one a recipient cannot sell or.

Partner Tax t. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is. Basic Info for RSU Calculator.

Restricted stock is a stock typically given to an executive of a company. Many employees receive restricted stock units RSUs as a part of. Plan For the RSU Vesting Event Once youve used.

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. The beauty of RSUs is in the simplicity of the way they get taxed. Carol Nachbaur April 29 2022.

Ad Thinking of switching from stock options to RSUs restricted stock options. Restricted Stock Unit Rsu Tax Calculator Equity Ftw It is founded in the year 1961 in one of the small villages in Italy. Also restricted stock units are.

RSUs are taxed as W. 1 day agoThe fall from 97 in 2020 to 52 in 2021 was largely due to enhanced child tax credits provided to low-income families during Covid The US child poverty rate fell by nearly. Compare how the total payout may change between options and RSUs.

Claires tax on the RSU vest. Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. Long-term capital gains tax on gain if held for 1 year past.

Heres the tax summary for RSUs.

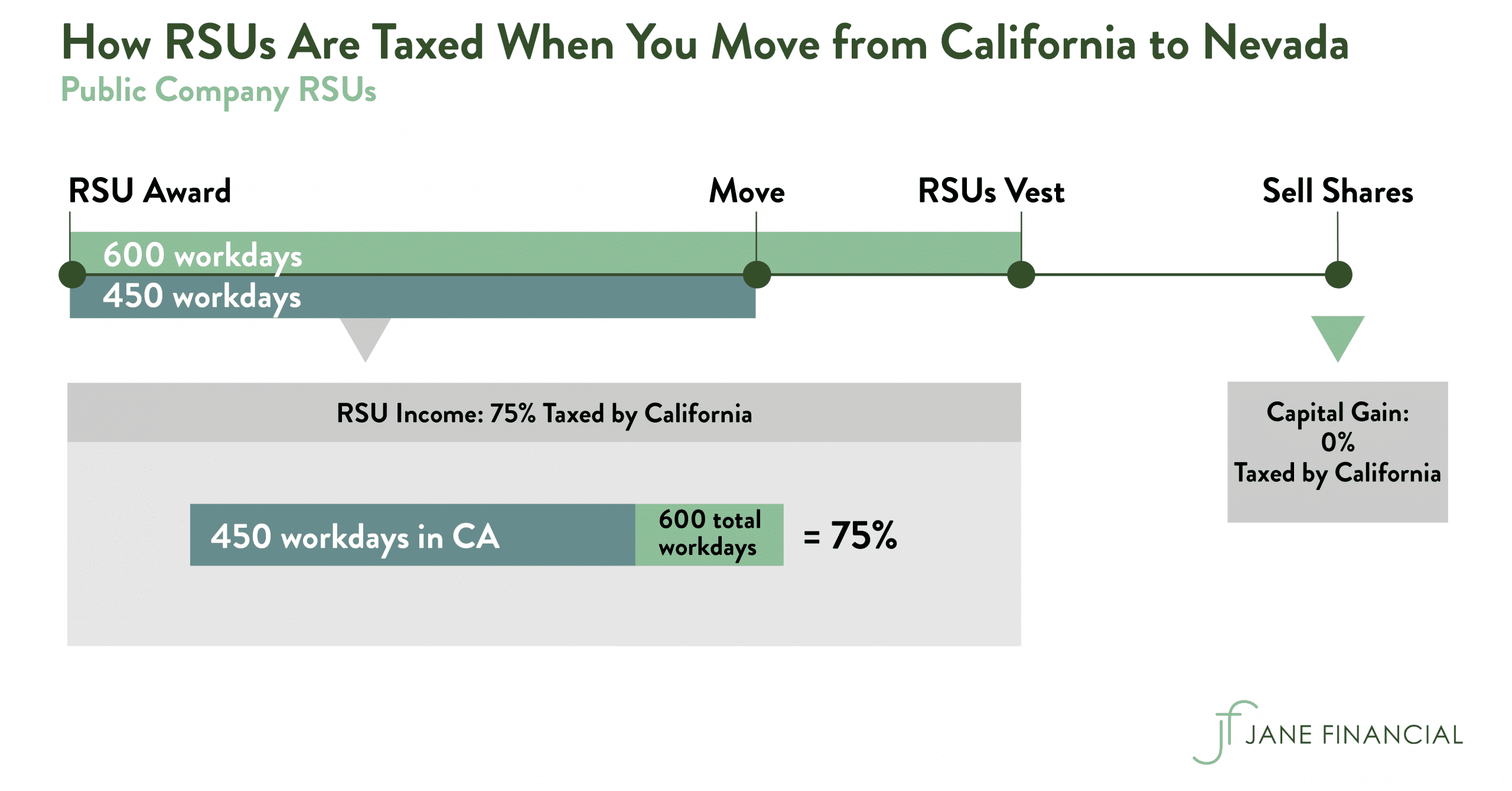

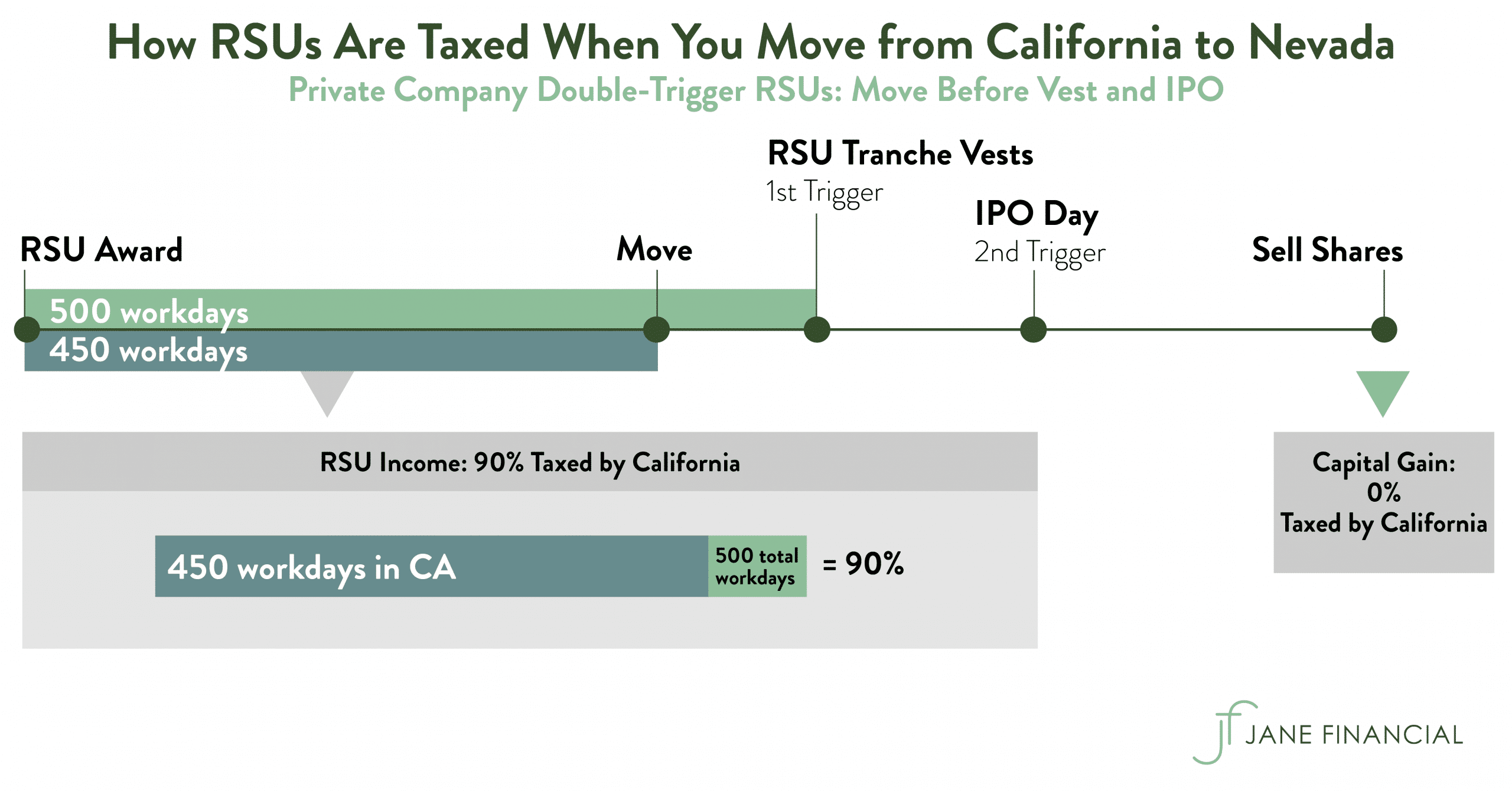

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Rsus Facts

Rsu Taxes Explained 4 Tax Strategies For 2022